![]() Post last updated June 2nd, 2017 also Wealthfront dropped their account minimum to only $500 in 2015 (it used to be $5,000 to open an account).

Post last updated June 2nd, 2017 also Wealthfront dropped their account minimum to only $500 in 2015 (it used to be $5,000 to open an account).

Over the last nearly half decade I’ve been a full time business owner, I’ve been fortunate enough to continually grow my business and earn more money each and every year.

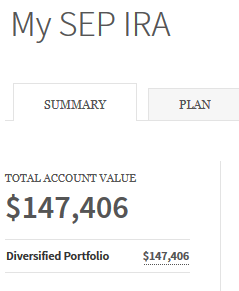

A large portion of the money I earn gets reinvested back into my business in the form of software development expenses, buying websites, running websites and developing new websites etc but some of the money is invested into my SEP IRA – in this case through Wealthfront* (which I’ll get to in a moment).

Wealthfront Video Review

I filmed a brief review to explain why I invested $51,000 with Wealthfront for the 2014 tax year here:

I cover some more examples not mentioned in the video review below, but if you’re a self employed individual and own your own business you’ll find out why I decided to go with Wealthfront.

Note: For another take on Wealthfront, check out my friend Jim’s review of Wealthfront.

Why I Went With A SEP IRA For My Business

There are a few different retirement options for self employed people that you can read about here, but ultimately the primary reason why I went with a SEP IRA is because it has huge contribution limits (and would allow me to contribute to future employees I hire vs an individual 401k which would not).

For the 2013 tax year the SEP IRA contribution limit is up to 25% of the employee’s compensation or 20% of your net earnings from self� employment with a cap for the 2013 tax year at $51,000.

You can use this nifty calculator to help you determine what you can contribute based on what plan you select as a self employed individual or corporation owner. Here’s the official IRS PDF link.

I’m not disclosing my total earnings for 2013 (I shared some stats from October and November before), but with some basic math you could determine that if I’m investing the $51,000 cap for the 2013 tax year that I did pretty well for the year.

I want to briefly cover what I did before and why I changed.

Why I’m Not Investing With American Funds Anymore

In the past I invested money in a SEP IRA with American Funds, but after spending a sizable chunk of time researching all of the alternatives available I’m not going to work with American Funds anymore.

Why should I have to pay a financial adviser at American Funds a high front end commission on Class A shares along with other fees (like I did in the previous year based on my advisers recommendation)?

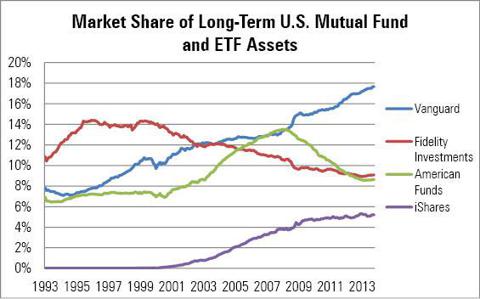

The argument would probably be that “our managed funds perform better” but I don’t agree and for about half a decade millions of other investors also moved away from American Funds, Fidelity and other high fee mutual fund companies.

You can see this shift away from higher fee to the lowest fee company Vanguard here:

Market Share Of Mutual Fund Companies 2013:

Vanguard is famous for low fee funds which is part of why they’ve captured so much market share source

Again with further research I later learned that I should have probably went to a fee only financial advisor (“fee only” is key there) if I wanted help with my investments.

With a fee only financial adviser they get paid the same regardless of what investments you make. They typically charge by the hour or if you’re a higher net worth individual they offer management of the portfolio (I spoke with one fee only financial adviser before deciding to go with Wealthfront).

Besides, what incentive is there for an American Funds adviser to tell you to buy actual real estate for example when they can recommend an American Funds real estate focused mutual fund they would get paid a commission on?

So what is the alternative?

Why I went with Wealthfront for my SEP IRA

Wealthfront is the largest and fastest growing software based financial advisor and at the time of publishing this post in April 2014 they have over $700,000 million under management. May update: $800 MM under management now

I’m a firm believer in the idea that “software is eating the world” as Marc Andreessen once wrote and that the financial industry is one such area that needs to be disrupted.

Wealthfront was an attractive option for me at only .25% in yearly fees on my assets over $15,000. I got my first $10,000 + extra $5,000 managed for free because I joined via a referral link – here’s my referral link (if you sign up with mine you get an extra $5,000 managed for free and so do I).

Even Warren Buffet suggests low fee investments are the way to go. He specifically suggests index funds, but WealthFront deals with ETF’s (largely because they can be traded via API which helps to enable all of the wonderful software wizardry they can do now to automate trades etc).

Related reading:

Why EFT’s are better than Index funds or an article outside of Wealthfront’s blog would be this one from Investopedia

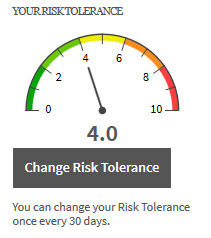

Wealthfront automatically invests based on your risk profile (they ask you a series of questions to determine this number). Because what I do for the bulk of my business income is pretty risky I want to be less risky when it comes to my backup plan.

Wealthfront automatically invests based on your risk profile (they ask you a series of questions to determine this number). Because what I do for the bulk of my business income is pretty risky I want to be less risky when it comes to my backup plan.

Update: May 7th, 2014 I updated my risk tolerance to 7/10. I’m young. Plenty of time to make more money if my retirement portfolio underperforms.

You can change your risk profile once every 30 days. I will probably increase my risk a little bit though because I’m young.

I consider the success of the businesses I’m building and my focus on living well within my means will help me achieve financial independence at a young age (certainly before I’m 40, but possibly before I’m 35) whereas investing into my retirement account is something I’m doing more out of a desire for a sizable backup plan.

Ultimately I believe it’s incredibly difficult (if not impossible) to accurately time and predict the market 100% of the time when it comes to investing so a more passive investing approach makes a lot more sense to me than fiddling around with individual stocks.

I’d rather instead focus my time and efforts on growing my business and let my backup retirement plan work automatically for me and with the lowest fees possible.

Wealthfront isn’t just for retirement accounts of course and if you’re only putting in a low single digit percentage into your retirement via your company managed 401k in my opinion that’s not enough.

It’s worth investing in addition to what you are already doing for retirement which you can do with Wealthfront.

If you were to open a separate non retirement account (taxable income account) Wealthfront also offers automatic tax loss harvesting which in theory should help you earn more from your portfolio. This is best explained by their video here.

What are my results so far?

Obviously it’s far too early to tell but I plan to update this post after my first year to share my results.

If you want to try out Wealthfront it’s $5,000 to open an account at this time (perhaps that will change in the future) and like I mentioned before if you use my link you get $5,000 extra in fee free management and so do I.

Clearly they’re using a similar growth strategy like Dropbox does by offering more free space when referring others.

You can sign up for WealthFront here

(There are no account set up fees, deposit fees or any crap like that.)

What are some other software style alternatives to Wealthfront?

Betterment was the other primary company that cropped in my research as the best alternative to Wealthfront but they don’t support SEP IRA’s yet (lame) which is what I was looking for.

11/26/2014 Update: I’m testing out Betterment now as well

Their annual fees can be even lower than Wealthfront: .35% with a minimum $100 monthly deposit, .25% with a $10,000 minimum balance and .15% with a $100,000 minimum balance (As of April 2014 – see fees here)

You can read the differences between Wealthfront and Betterment via this Quora question as well. It was useful for me but again without a SEP IRA option the decision was easy.

Most of the other software options I researched out there didn’t interest me (primarily because they were much higher fees) but if others come up I’ll probably try them as well. Personal Capital was one of the only other options that I was interested in, but they have higher fees. Along with the higher fees they give you one on one attention though. At the very least they have a cool net worth calculator that’s worth signing up for it’s similar to Mint.com but for tracking net worth. Check out Personal Capital here.

Overall, retirement and investing isn’t something I normally write about but for self employed folks as well as those of you with jobs it’s important to be investing your money into something. My current opinion is to do so with Wealthfront:

You can sign up for Wealthfront here

(Again, there are no account set up fees, deposit fees or any crap like that)

Note: I’m not an accountant or a professional investor, what I shared above is my opinion based on my own research and what I’ve decided to do for my business. As always you should consult a professional.

*If you sign up for Wealthfront using my referral link you get $15,000 managed for free (instead of the usual $10,000 managed for free). I will also get an extra $5,000 in funds managed for free as well (thanks).

May 9th Portfolio Update:

I’ve surprisingly only had four people sign up for WealthFront via my referral link but only one has deposited funds into their account. Thanks kind friend for the extra $5,000 in fee free management and you’re welcome for your extra $5,000 in fee free management as well.

Obviously we need to see performance over a longer period of time than just ~60 days but I updated this post because as I said in my review I thought I would go more risky and so I did. I went from 4 / 10 to 7 / 10 on May 7th which mainly upped my emerging markets position and reduced my corporate bonds.

How Much Money Have I Made With WealthFront? August 1st, 2014 Update

Get $15k managed for free using my link ($5k extra)

I’m still using WealthFront in 2016 – Jan 4th, 2016 Update

I didn’t cap my SEP IRA in 2014 because I didn’t make a final deposit in time (whoops), but I capped my SEP IRA in 2015 with another $53,000 invested.

In the second half of 2015 there was a bit of a dive in the market so I gave up a fair chunk of my gains, but again this is a retirement account. A small blip now won’t matter much ~30 years from now when I start to take this money out. I expect before I’m 40 that unless there is a major market change and that I can continue putting $50,000+ into a SEP IRA that I’ll have close to $1 million in my SEP IRA by then.

Closing Comments (most important part of this review):

My best returns have always come from investing in myself through improving my marketing skills, investing in hiring employees or contractors for my businesses etc. I simply invest in retirement to lower my tax burden for the year otherwise I’m going to give away 39.6% of the $50,000+ I put in to taxes anyway (and I’m sure we haven’t seen the last of the tax raises).

Up Fuel

Up Fuel

Hey Chris,

Thanks for sharing. I’ve been trying to decide between WealthFront, Betterment, and our family’s traditional financial advisor guy on and off for almost a year. Being a grown up sucks 🙂

Excellent to point out that your best returns are usually going to be by investing in yourself and growing your business, but good to have some funds set aside as well.

Cheers,

Nick

Hey Nick,

Yah I mean I’d like to think that in ~30 years when I’m 59.5 years old and can access this money penalty free I’ll still be in a huge tax bracket and earning even more money from some fantastically large business I’ve built but perhaps I’ll just shoot for being done working at 35.

I’m 30 now and my goal is to finish paying off our house this year. If I continue the trend I’ve set for the last ~5 years I’ll earn more money this year than I did last year and can easily accomplish that goal. If I pay off my house then my monthly expenses will drop even further and I can continue to cap out my SEP IRA and save a bunch of extra money not used in my business in post tax places like Wealthfront or Betterment.

We shall see.

Great review, I love wealthfront as well. I like the level of sophistication and comfort they provide. here is my review of them. http://lookingforawesomeness.tumblr.com/post/80885585933/wealthfront-review

I had not heard of Wealthfront before, so thanks for mentioning it. I actually took the opposite path as you and moved away from a SEP to an individual 401k. In my situation I’ve been able to contribute more to the 401k because of the employer match. I use an S-Corp so I am technically an employee of my business. I don’t know much at all about any of the technical details, just that I was advised I would be able to contribute more in a 401k and two years in that has been the case.

Hey Marc, that’s interesting. I was under the impression that an individual 401k / Keogh Plan for self employed folks still had the same $51,000 2013 limit of a SEP IRA. You’ve been able to put in more than $51k?

Edit: After looking some more perhaps you’ve been able to put in more because you don’t have to put in based on a percentage of your income (like the SEP IRA does with the percentage or cap at $51k). That’s actually what I assume.

Chris,

I think I misunderstood when I was reading the article. You’re right, my limit was $51,000 for 2013. The way it was explained to me, if I remember correctly, was that I had the same 20% limit with a SEP or a 401K, but with a 401k I could also do an employer match. That match doesn’t allow you to go over the cap, but it does allow you to get more than 20% unless your income is high enough that 20% would be more than $51,000. I could be totally butchering that, I just know in my situation a few years ago it worked out that I could contribute more through a 401k, but at that point my income wasn’t high enough for the $51,000 cap to be an issue.

Ah ok that makes sense. Yah my LLC is operated as a pass thru entity so I’m not technically an “employee” of my business I guess because all the income just gets applied to my taxes.

You may want to look into S-Corp status. My business is an LLC also and I used to be pass through until 2 or 3 years ago, and it’s been a much better situation for me.

Will do thanks

I agree with Marc, tax burden on S-Corp is better than LLC but you can do it without having to change your structure by electing to file taxes at S-Corp.Its a weird loophole that IRS allows for now.

Hey Chris, nice review. I love Wealthfront as well — I’ve been using them for both my retirement and taxable investments since early 2013.

Hopefully this doesn’t sound too much like a shameless plug, but as a business owner you might be interested in the analysis I did on Wealthfront’s business model. When will they be profitable? I included the link as my URL on this comment in case you are interested. I’d love to hear your thoughts and feedback if you read it!

Interesting analysis. Yah I sort of expected that they wouldn’t be profitable / won’t for a while. With scale they’ll get there though.

Thanks for this article and all the helpful comments. I’m hoping to read more about wealth front and get started on it. I’m fairly new to investing at 25 years of age. A reviewer mentioned that wealth front isn’t “profitable”. What does that mean really? Does it mean you’re not seeing gains on your investment? Sorry for the dumb questions. I’m so new to this!

Hey Kimi, I can only assume that they mean WealthFront as a company isn’t profitable yet but if that were true it wouldn’t surprise me. Many of these tech companies start and stay unprofitable until they reach a large scale.

But I’ve personally made money with them so far perhaps I’ll do another blog post with my results at a later time.

Thanks for the review about Wealthfront. It looks very interesting and I definitely want to check it out but I’m a bit bummed out about the $5k minimum. My goal is to buy my next house (probably about the same price range as yours) with at least 50% cash so this would be a substantial dent.

I’ve used Vanguard for years and have liked them and the fairly hands-off approach I can have to investing. Embarrassingly, I didn’t even know about EFT’s until I read this post.

Would you say EFTs are as hands off as investing in a mutual fund?

Hey Mika, I wouldn’t be embarrassed (unless your job were as a financial planner or something lol). Wealthfront – as a whole – is designed to be hands off. You answer questions to set your risk and then they automatically rebalance the portfolio for you so in that way yes it’s pretty hands off. I am going to up my risk to like 8 or 9 though and then not look at it again except for when I occasionally log into my net worth tool at Personal Capital

customer service is sorely lacking, and getting back your investment is timely and overly complicated.

Hey Jon, well I’m not an employee of Wealthfront so I can’t speak to that. I can only share my experience that it hasn’t been hard for me.

Whats your return so far?… I actually do my own investing with TDAmeritrade and its been going well since I started in 12. I only invest in ETF’s though not on individual stocks. You could be earning a 5 – 7% a month (yes, a month) on that investment by being self directed. Just need to know how. I need someone like you to help me put an eBook together about this 🙂

I’m at like 7% or something. I set my risk tolerance at 7 / 10 and am pretty auto pilot about it. SEP IRA investing is like my backup, backup backup plan. If I do everything right I won’t need the money to live on it will just be something extra.

Hey Chris,

Can you please share your current standing of your wealthfront personal and IRA account? Just curious!

Still using WealthFront I’ll update this post

Chris, do you have a update on Betterment and Wealthfront? Would love to hear more of your thoughts on the two.

I put $53,000 into WealthFront for the 2015 tax year. I’m still using them for my SEP IRA and satisfied but the market took a bit of a mini dive in 2nd half of 2015. This is the long game though and I view the money I put into retirement as backup (with my primary plan to build wealth through the profits of various businesses I’m building).

Thinking about liquidating a precious metal Ira and transfer it to a Roth IRA in wealtfront. About 7000$ Would it we be worth it? Your columns are good sdvice

I’m not a financial advisor so I can’t really tell you what to do, all I’m really doing with this post is saying what I’m doing.

I am thinking of transferring my SEP-IRA from Etrade to Wealthfront and that’s how I stumbled onto your page. Thanks and please keep me updated as I decide what to do. I don’t have time or the will to manage my finds myself anymore and I am nearing retirement.

I’ve been in Wealth front for 3 years now and it’s been the worse investment ever.

Since 7/1/14 I made only .00656 gain per year. (It’s a fairly aggressive plan they offer)

That’s an embarrassment for Wealth Front.

I feel they should be investigated for mass mismanagement of funds.

I am soon to be a ex-Wealth Front customer.

You would be much better off putting your money in an S & P 500 ETF or Aristocrat ETF Fund. Listen to Jim Cramer, be take the time to protect your own money and educate yourself in investing. After all it’s your financial well being you are going to be ultimately responsible for.

Don’t let the slick marketing fool you and make you feel all warm and fussy inside, they legally steal your money. If you sign up with them I suggest first ask what lucrative bonus’s have they received each year. 🙁

I’ll do an updated post with my returns, but again the risk profile, account type, when you invest etc all are going to influence.

This is my “sophisticated” investor opinion:

The stock market over the long haul goes up. So I put extra money into the stock market via index funds with the goal to match what the market is doing.

That’s it.

If you like a McDonald’s Happy meal approach to investing, then that’s the type of approach Wealth Front will take with your hard earned savings. I would say over 3 years in a bull market and earning obnoxious low returns is proof enough Wealth Front is in this for themselves. They have a totally irresponsible way of handling investments. I got out and now manage my own investments and in one years time I’ve achieved between 19 to 25% or better gains. Don’t sit this Bull market out by parking your hard earned savings in a dead beat company. Remember these folks are from the Silicon valley area, some of the best and brightest scholars in the nation, they know what they are doing: Taking from your pocket and putting it into theirs and laughing all the way to the bank.

I’m confused.

Look up Jack Bogle.

Then look up Vanguard.

More people have money invested with index funds than any other asset class on the stock market.